The USA Just Broke the Record for Most Tariff Revenue EVER in a Month! 🇺🇸

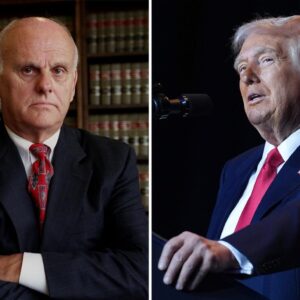

In a historic fiscal milestone, the United States has shattered its previous records by collecting an unprecedented amount in tariff revenue in a single month. This surge in revenue is attributed to the implementation of sweeping new tariffs under President Donald Trump’s administration, marking a significant shift in U.S. trade policy.

📈 Record-Breaking Tariff Revenue

According to recent data, the U.S. Treasury brought in a record $5.6 billion in tariff revenue, surpassing the previous high of $5.5 billion in October 2018 . This surge is primarily due to the new 10% baseline tariff on all imports, coupled with higher levies on goods from 57 larger trading partners. The implementation of these tariffs has significantly increased customs duties receipts, contributing to the record revenue.AJOTKathmandu Post+1Committee for Responsible Budget+1

📊 Factors Contributing to the Surge

Several key factors have contributed to this unprecedented increase in tariff revenue:

- Implementation of New Tariffs: The U.S. began collecting a 10% baseline tariff on all imports, with higher levies on goods from 57 larger trading partners. This move marked a full rejection of the post-World War II system of mutually agreed tariff rates .USFunds+3Kathmandu Post+3U.S. Customs and Border Protection+3

- Increased Effective Tariff Rate: The average effective tariff rate has climbed to around 22.5%, the highest level since 1909 . This increase has significantly boosted tariff revenue.USFunds

- Broader Trade Measures: In addition to the baseline tariff, the U.S. has implemented additional tariffs on goods from specific countries, further increasing revenue.Kathmandu Post

💰 Economic Implications

While the surge in tariff revenue has provided a temporary boost to the U.S. Treasury, experts caution about potential long-term economic consequences:

- Inflationary Pressures: Higher tariffs can lead to increased costs for imported goods, potentially raising prices for consumers and contributing to inflation.

- Retaliatory Measures: Other countries may impose retaliatory tariffs on U.S. exports, potentially affecting American businesses and farmers.The Guardian

- Supply Chain Disruptions: Increased tariffs can disrupt global supply chains, affecting the availability and cost of goods.

📉 Market Reactions

The financial markets have shown signs of volatility in response to the new tariff policies. While some sectors may benefit from increased revenue, others may face challenges due to higher costs and potential retaliatory measures. Investors are closely monitoring the situation to assess the long-term impact on the economy and markets.

🔮 Looking Ahead

The record-breaking tariff revenue marks a significant shift in U.S. trade policy and its economic landscape. While the immediate fiscal impact is positive, the long-term effects remain uncertain. As the situation develops, it will be crucial to monitor economic indicators and market reactions to gauge the full impact of these policy changes.