In a startling revelation that has sent shockwaves through federal oversight circles, the Department of Government Efficiency (DOGE), led by Elon Musk, has uncovered that the Small Business Administration (SBA) disbursed approximately $312 million in loans to individuals listed as 11 years old or younger during the COVID-19 pandemic.

The Discovery

DOGE’s investigation revealed that between 2020 and 2021, the SBA approved nearly 5,600 loans for borrowers whose sole listed owner was 11 years old or younger at the time of the loan. These loans were part of the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) programs, which were designed to provide financial relief to small businesses during the pandemic.

What makes this discovery particularly concerning is that many of these loans were associated with Social Security Numbers (SSNs) that did not match the names of the listed borrowers, raising significant questions about the SBA’s verification processes.

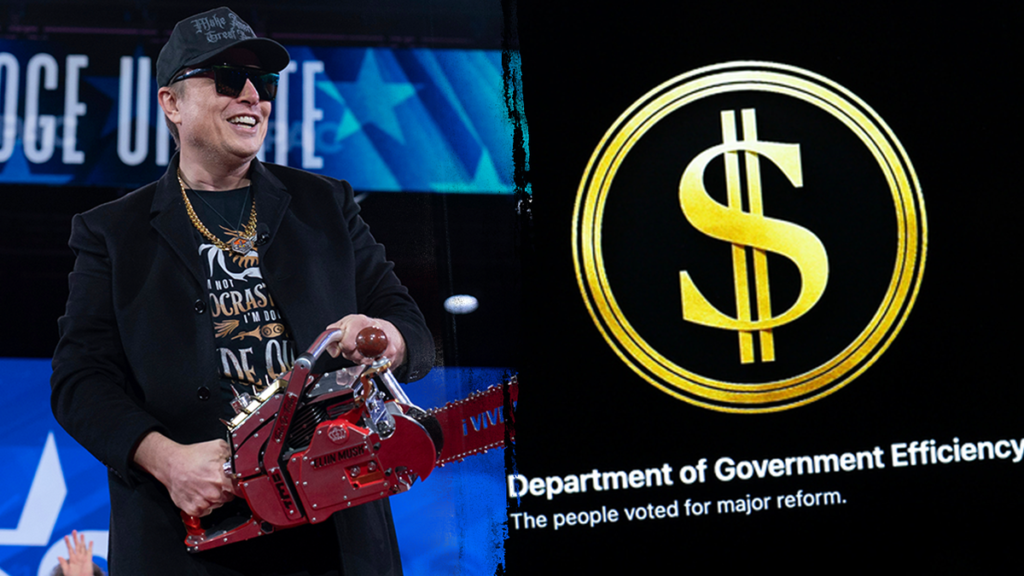

Elon Musk’s Response

Elon Musk, who heads DOGE, expressed his astonishment at the findings. In a social media post, he highlighted the absurdity of the situation, noting that the youngest recipient was a nine-month-old who received a $100,000 loan. Musk’s post read, “No more loans to babies or people too old to be alive.”

Broader Implications

The revelations have sparked widespread outrage and calls for accountability. Lawmakers from both parties have expressed concern over the apparent lack of oversight in the SBA’s loan approval process. Some have called for criminal investigations into how such significant sums could be allocated to ineligible recipients.

Next Steps

DOGE and the SBA are reportedly working together to address the problem. Measures being considered include pausing the direct loan process for applicants under 18 and implementing stricter verification protocols, such as requiring date of birth collection for all direct loan applications.

As investigations continue, the focus will be on identifying how these loans were approved and who ultimately benefited from them. The findings underscore the need for robust oversight mechanisms to prevent such occurrences in the future and to ensure that relief funds reach their intended recipients.

Note: This article is based on information available as of April 23, 2025. Further developments may have occurred since then.